May 2021: Stability Amidst Shortages?

Looking at May 2021 markets, we’re seeing what looks like stability returning to the pricing of some commodities as covid-related supply chain disruptions are resolved. However, global shortages and demand spikes which were previously discussed in April’s Wreckonomics article are hovering around record heights, exacerbated by increased demand as societies around the world begin to return to something more closely resembling things pre-Covid. Restoring our economies is increasingly challenged by shortages in many unrelated segments, see: How the World Ran Out of Everything.

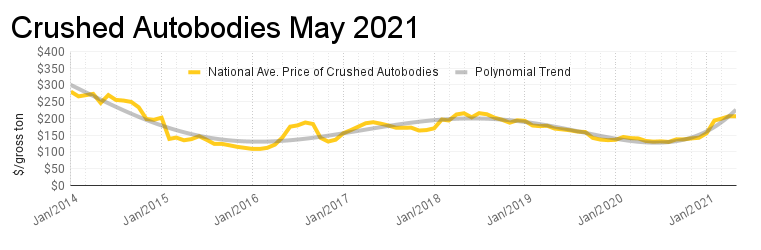

Crushed Auto Bodies:

As the perfect case in point for stability, there was literally no change in the average national price for crushed auto bodies in the US for May compared to April. Even broken down regionally, there was very little change within each zone.

Platinum:

As another example of stability, the price for platinum has remained relatively flat, fluctuating less than 2.25% up or down per month since the March, in contrast to monthly price increases seen from last November through February.

Rhodium:

Rhodium, which had seen consistent and frequently drastic price increases since summer of 2020, actually had its first price decrease since May of that year, dropping 5 percent to close to its March 2021 price. To add some perspective to this 5 percent price decrease, Rhodium is still over two and a half times the price it was in May 2020, which in turn was over nearly 1.7 times its 2019 price. Historically, rhodium price increases are related to automotive emissions legislation, but the most extreme peaks in Rhodium prices are the result of supply chain disruptions, of which the pandemic is certainly a most recent example.They’re typically followed by decreases as industry responds to these prices by implementing means of reducing rhodium use.

Despite Covid being less of a factor, Rhodium’s price still could experience support due to many nations’ commitment to reduce automotive emissions, until their efforts to reduce the usage of rhodium in meeting emissions standards begins to take effect.

The effect that the competing dynamics discussed in the beginning of this post will have on commodities pricing as we move into the second half of 2021, namely a less restricted supply chain vs increased demand due to less restricted economic activity, is definitely going to be interesting. Add in the huge variables of any significant changes in trade policy with China taking place this year (thus far, they haven’t), and also the success or failure of pending infrastructure legislation to the equation, and the takeaway, to the state the obvious, is that where we’ve observed stability, things will remain stable until they’re not. Continued stability is far from being a given.