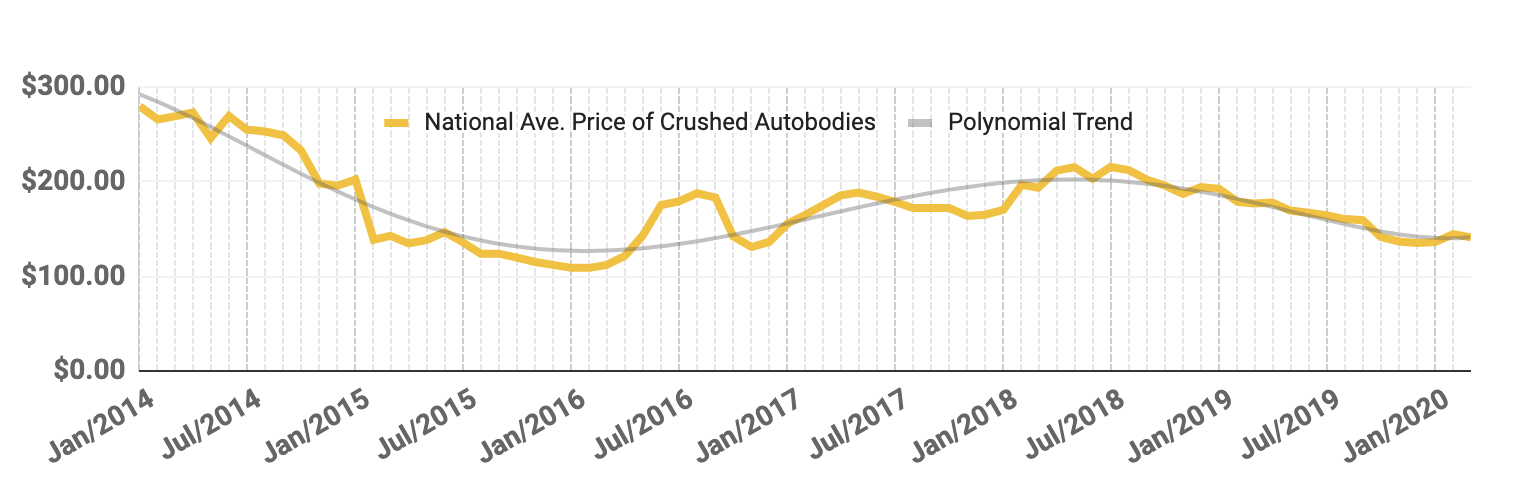

In recent years, US steelmakers have often made Chinese mills’ overproduction of steel their scapegoat as to why they lack pricing power, yet at the same time China has also always been one of the world’s largest ferrous scrap importers. However, this status may rapidly shift considering recent trends in Chinese economic activity, or lack-thereof. During the first two months of 2020, steady U.S. steel stocks and the expectation of a good year for the construction and automotive sector masked the severity of global steel overproduction. Now, ferrous scrap processors have seen fewer of their export tons head to China. This sparks cause for concern due to the fact that an abundance of steel in the global market is likely to pressure ferrous scrap and steel to reduce in price.

What is most puzzling is that this has been going on for several years, and no party showed genuine concern. In fact, as recently as mid-February, North American steel remained completely optimistic in regard to business despite obvious economic slowdown in China. The global steel market’s troubles go beyond overproduction while demand remains low. Now add in a pandemic that affects every aspect of the industry’s supply chain. The Chinese economy’s inability to meet their usual level of import demand may cause short-term problems in the near future of this fiscal year. In sum, the way that industry experts respond to this adversity will be particularly interesting, especially if the coronavirus continues to spread. Come back in two weeks to see a follow up and analysis of April 2020’s national and regional scrap steel price updates.