As we steam through 2024 at breakneck speed we wanted to close the book on 2023 with one final look back at the topsy turvy markets of last year. Wreckonomics© is our set of insights into the sustained and specific appetite for low value and end of life vehicles and we saw a ton of changes in the last year. In this edition we’ll try to examine all the extraneous forces that influence our segment and make sense of this post pandemic reality.

As with past Wreckonomics coverage, much of this is not new information or propriety to ARS but it should present a unique assembly of ideas. The insights presented here are supported by the Wreckonomics YIR Resource Document and slides available

The key buzzword last year was definitely ‘affordability’. Specifically what the rising inflationary pressures have done to the vehicle sector and how the costs of purchase, maintenance, repair and operation are affecting vehicle owners, fleets and insurance companies. In particular, the worsening shortage of qualified repair technicians further complicates future costs. These pressures produced interesting results for our low value segment.

So let’s breakdown the Wreckonomics world for 2023:

Macro Economic Minute (slides 6 -10)

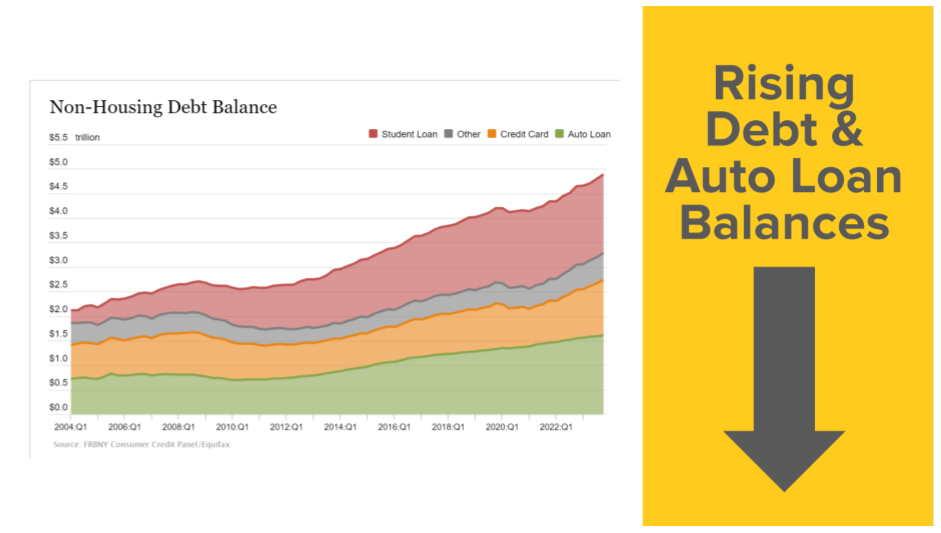

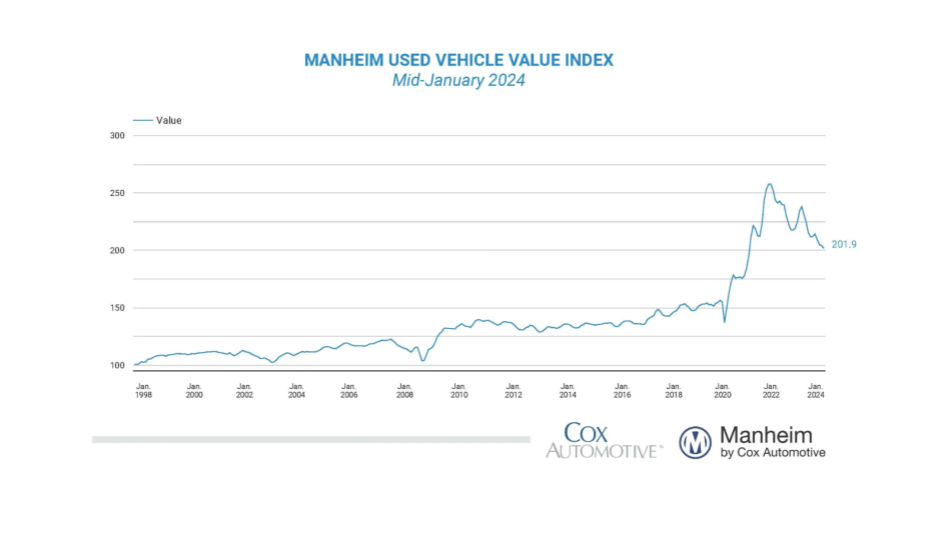

The economic outlook is a source of such speculation. It is impossible to predict where the whims of the market will take us but as it relates to our segment, the recent easing of inflationary pressures is lowering car values and replacement costs. However, these values still remain much higher than a few short years ago and when commingled with other rising costs of living, consumer borrowing is shooting way up to what could become uncomfortable levels.

Transportation & Mobility (slides 12 -14)

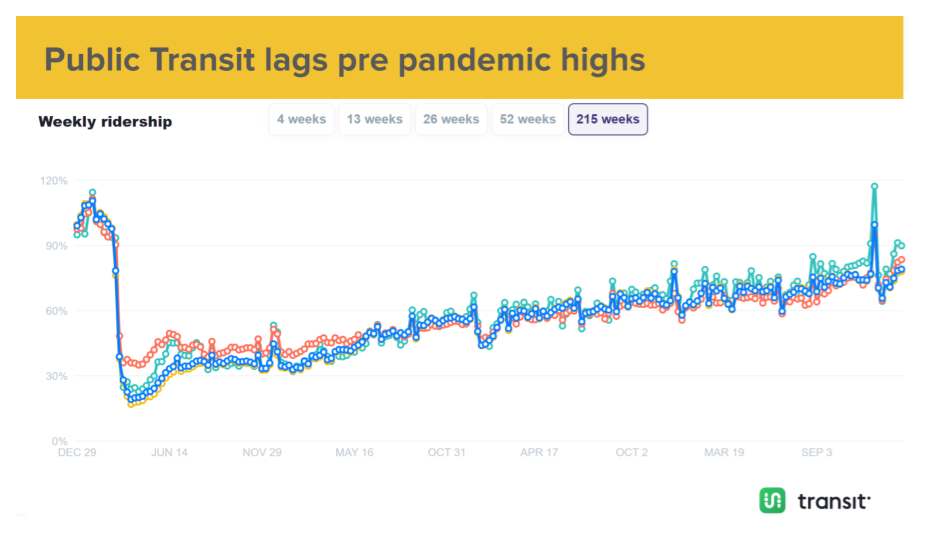

Overall transportation grew again last year. Total Miles Driven grew, extending a 50 year trend that was only temporarily upset but COVID-19. While total miles recovered, the transportation behaviors don’t exactly match up to pre-pandemic. Work from Home (WFH) and other commuting changes result in different trip length and frequencies. You can see the effect of some of these differences in commuting data.

And though EV sales soak up headlines, Americans are not ready to end their love affair with carbon emissions. While EV purchasing rose again in 2023, Internal Combustion Engines still account for the majority of new car purchases.

And though EV sales soak up headlines, Americans are not ready to end their love affair with carbon emissions. While EV purchasing rose again in 2023, Internal Combustion Engines still account for the majority of new car purchases.

Supply (slides 15 -20)

Vehicles in Operation (VIO) rose again last year to over 286 million units. This continued a 50 year trend for VIO. However there are some interesting forces that are trickling down to our low end segment and our auto recycling appetites

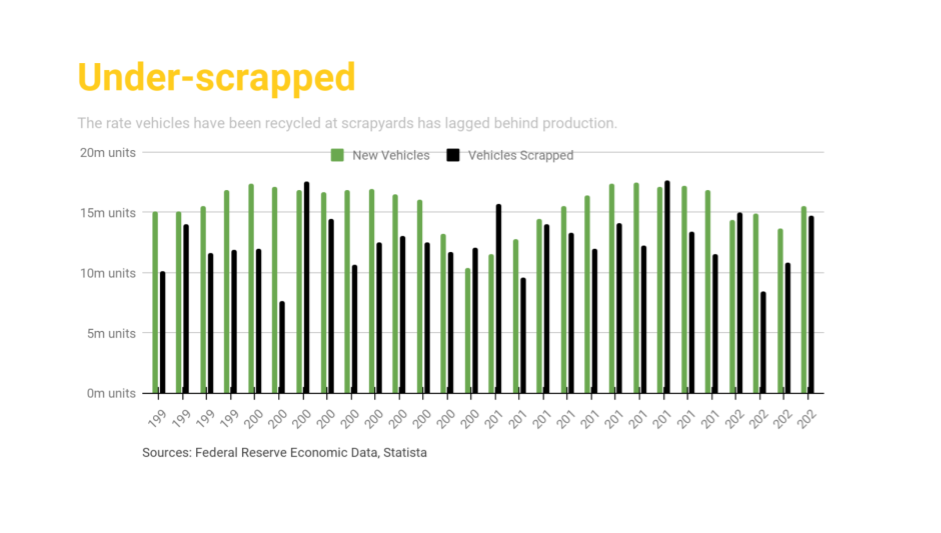

However VIO doesn’t tell the whole story about supply. One positive for our recycling partners is that it appears vehicle scrappage rates approached new car production for the first time in many years. This is an indication that the ‘retention pressures’ in the auto sector have eased and US owners may not be holding on to their vehicles as tightly as previously thought. This may be in part due to the rising expenses of automotive maintenance and repair. From November 2013 to November 2023 vehicle repair costs rose 4.1 percent per year, for an overall change of 49.8%. These extreme cost changes have made the maintenance of older vehicles far more expensive for Americans.

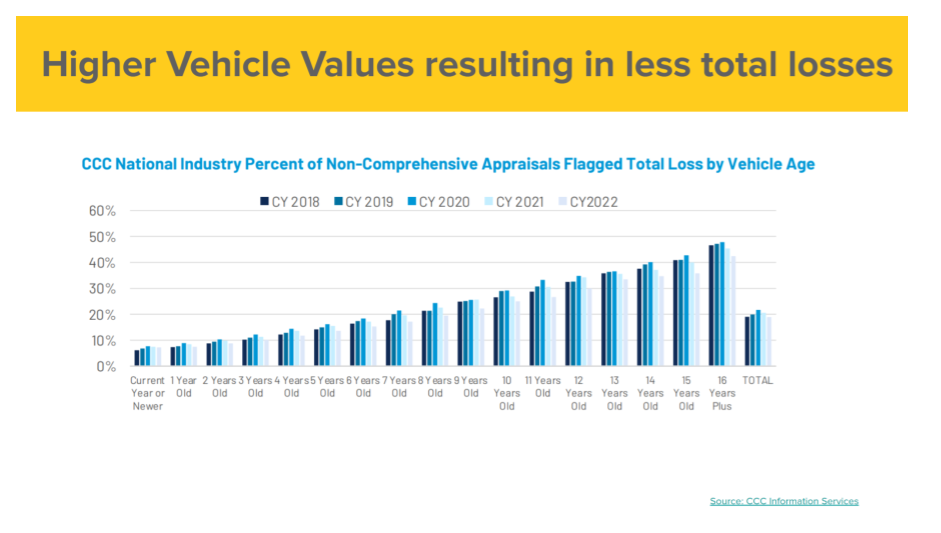

Additionally, the availability of salvage units is hampered by the increased value of vehicles resulting in lower total loss ratios.

Values & Wholesale (slides 21-23)

While the wholesale supply has stabilized and is expected to be strong for years to come, vehicle values are still very much in flux. Wholesale closed the year down 7% year over year but still way up over pre pandemic numbers. It’s interesting to note that wholesale has given up over 50% of the pandemic rapid gains in the market but still spectacularly above 2020 values.

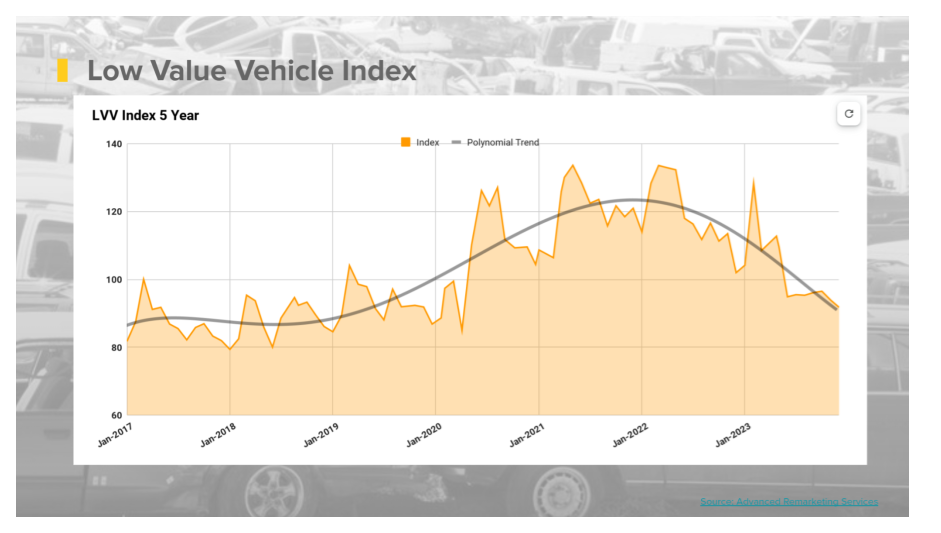

Unique to our services, ARS tracks the market on low end vehicles on a daily basis. We pull wholesale market data on high mileage, high year, low ACV units and use a mix of our own data and observed activity to produce an index that helps us work with our clients to make remarketing and channel decisions in real time. Our ARS Low Value Index sees a more significant relapse to pre pandemic values based on auction performance of similar assets. This is attributable to several things including the appetite for low value assets becoming more specific as competition wanes and also the influence of much higher acquisition fees to our recycling partners.

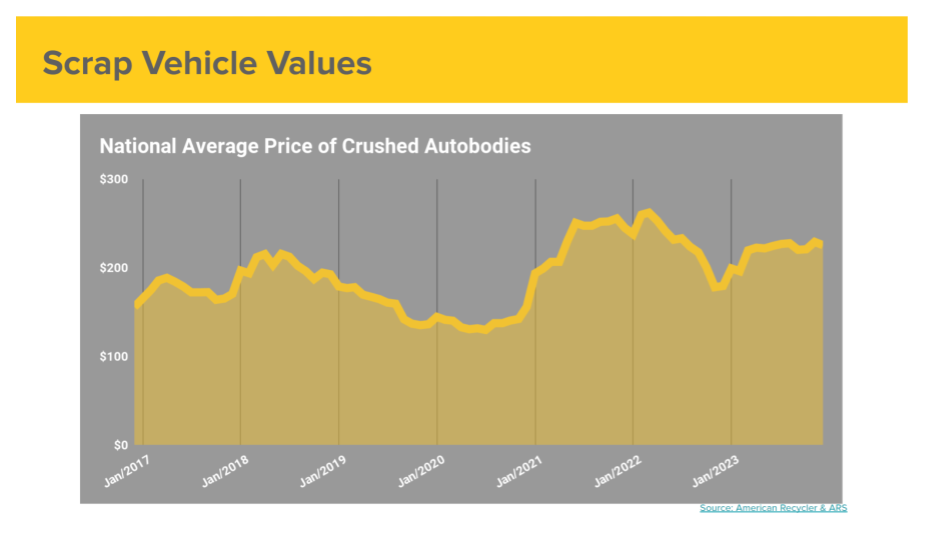

Scrap Performance (slides 24-28)

Scrap Performance (slides 24-28)

For our Recycling partners we maintain data related to scrap values, core demand and rare metals collected from end of life vehicles. We update these forces in our Markets & Metals series. In 2023 the market was surprisingly stable overall, you can see the price performance for ferrous, aluminum, rhodium, palladium and other metals in our resource HERE

Claims Data (slides 29-33)

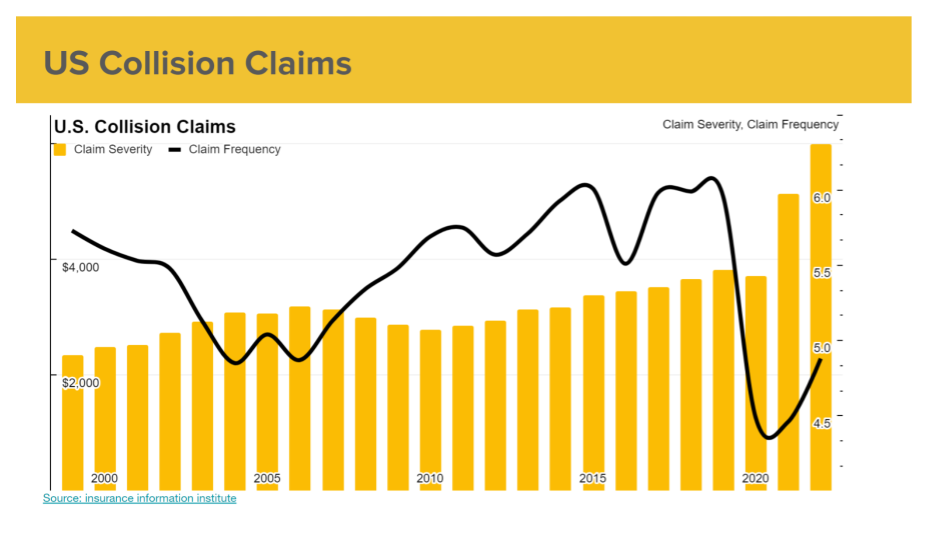

In the Auto Physical Damage funnel of Wreckonomics, we see several forces at work, including a steep rise in incurred losses on auto damage, related at least in part due to the higher severity related to vehicle and part value increases. These expenses are the primary reason that Auto Insurers are reporting ‘historically bad’ combined ratio results which is expected to push auto insurance rates even higher in 2024.

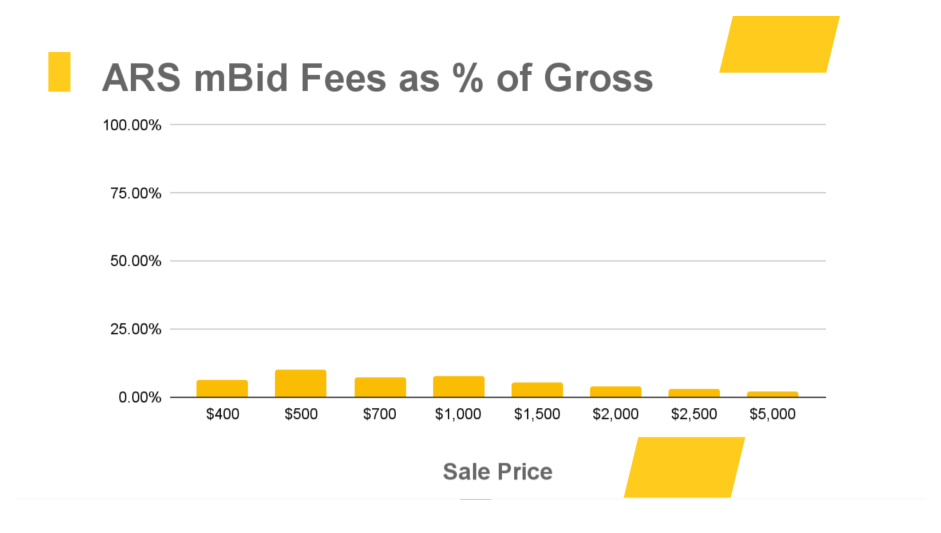

Acquisition Costs (slides 34 -37)

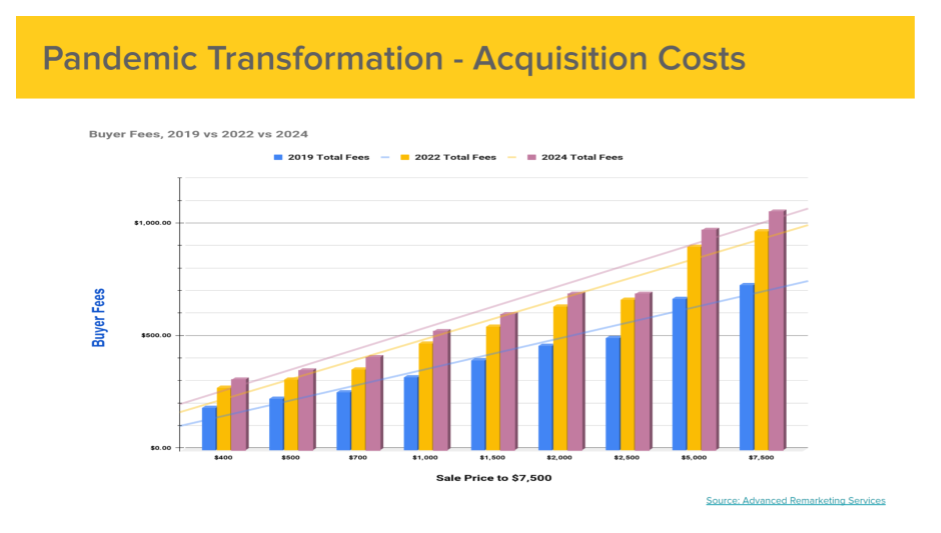

During the pandemic our Auto Recycling Partners were forced to look to solve raw material needs caused by retention pressures. As these tensions ease the system is reverting back toward more segmented and siloed domestic appetites. However one thing that is not reverting is the huge growth in acquisition costs our partners are paying through traditional channels. You can see in the chart below the historic ‘bite’ taken out of remainder value by auction fees and services.

Partners purchasing through ARS have been largely protected from this escalation in fees. Sellers on our mBid platform continue to see a much higher recovery ratio for vehicles sold by ARS.

Partners purchasing through ARS have been largely protected from this escalation in fees. Sellers on our mBid platform continue to see a much higher recovery ratio for vehicles sold by ARS.

Looking Forward (slides 38-40)

Looking back is an easy exercise, it’s looking forward that gets tricky. Here at ARS we see a good year in store for low end vehicles. The unaffordability of transportation will not sustain much longer. For cars and trucks to be affordable they need to be affordable to buy and maintain and repair. If these forces can’t align then manufacturers will struggle to sell new units and be incentivized to push prices down.

In our immediate future, the downward trend of used vehicle prices will provide buyers more lower and moderately priced options which should further relieve any lasting retention tension. Supply constraints are mostly resolved. Salvage recoveries are leaning back to pre-pandemic norms, and with the cost of repair and maintenance bound to stay very high due to a worsening shortage of qualified technicians, we expect it to be a very good year for retirement.

To meet the growing retirement needs, ARS spent the last year working closely with our partners in the Automotive Recycling Sector to launch the SHiFT National Vehicle Retirement Initiative. The Nation’s most environmentally friendly auto recycling program. SHiFT enables consumers, fleets, lenders, insurance companies and enterprises the ability to participate in the auto recycling process with measurable environmental benefits. You can learn more about SHiFT Here or reach out to ARS for more information.

ARS Helps our clients identify low value and ELV units in their asset pool, focus services for the remarketing or recycling of older and high mileage assets and our comprehensive approach delivers the highest possible returns.

If you have a pool of low value vehicles in your portfolio or if you’re looking at ways to maximize recoveries, please reach out to us at ARS. Send us an email; success@arscars.com

STAY IN THE CONVERSATION

Visit ARS Wreckonomics blog:

https://www.arscars.com/category/wreckonomics/

And subscribe for updates

*NOTE: All figures are believed to be reliable and represent approximate pricing based on information obtained prior to publication. Data is sourced from American Recycler, London Metal Exchange, iScrap App, and Scrap Monster. Advanced Remarketing Services is not responsible for the accuracy or completeness of the information provided, or for the use or application of information herein.