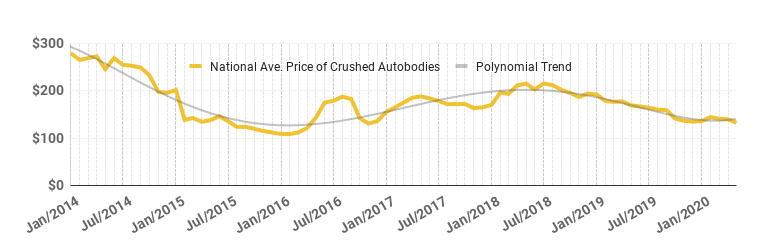

As previously discussed in the last Market & Metals post, we discussed the unknown impacts of the global pandemic and the difficulty forecasting into a wildly uncertain economic horizon. The roughly 20 drop that we observed at the beginning of the Pandemic in the U.S. has held relatively steady into May. Average scrap values fell 5 % from the April and roughly 22% from May 2019. Exports continue to lag significantly behind 2019.

We continue to watch closely the worldwide supply chain discussion and the impacts on worldwide manufacturing as the future remains murky at best.

The geopolitical impacts of the Pandemic are also expected to impact worldwide metals demand. Global backlash against China over the source of COVID-19 has increased trade tensions. In May, President Trump signified that he may pull out of the January 2020 Trade Agreement with China due to Coronavirus concerns.

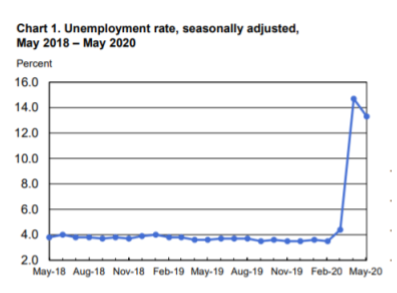

Domestically the introduction of the Paycheck Protection program has brought some degree of economic relief and market stability. There is also global attention to the U.S. Jobs Report, According the Bureau of Labor Statistics, U.S. employment rose by 2.5 million in May, and the unemployment rate declined to 13.3 percent.

This decline is expected to be a very good sign for international markets. However, there is still a ton of uncertainty surrounding all economic forecasts.