Third Quarter 2023: Low Value Trending Down, Scrap & commodity prices decline.

Despite prices on a downward trend, values are still higher than pre-pandemic levels and are reflective of prices seen in 2021.

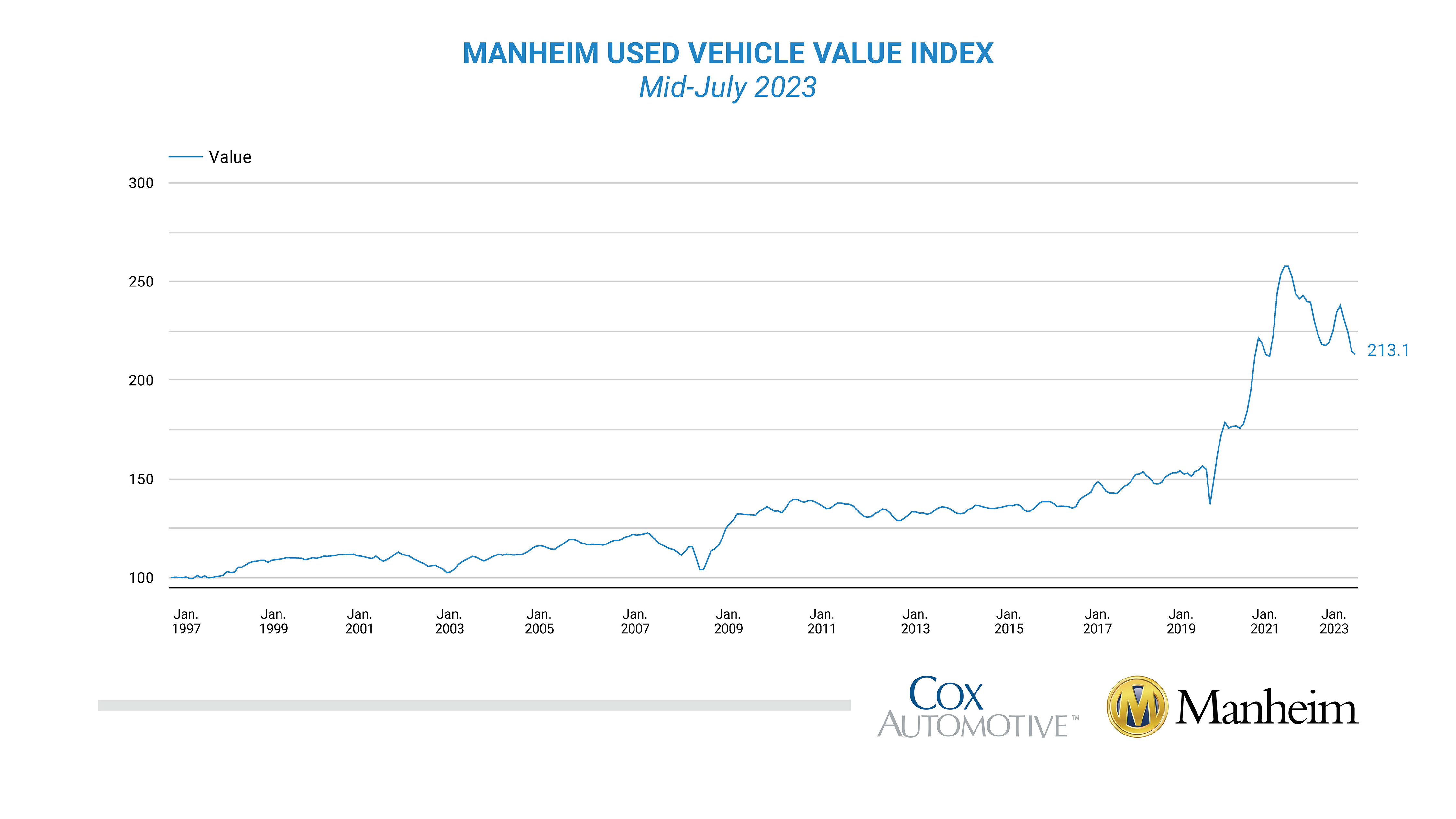

Wholesale Auto Values

The wholesale vehicle market is mirroring what we saw in 2021. In Q2 of 2023, wholesale used-vehicle prices dropped from the start of the year. See the Manheim index below:

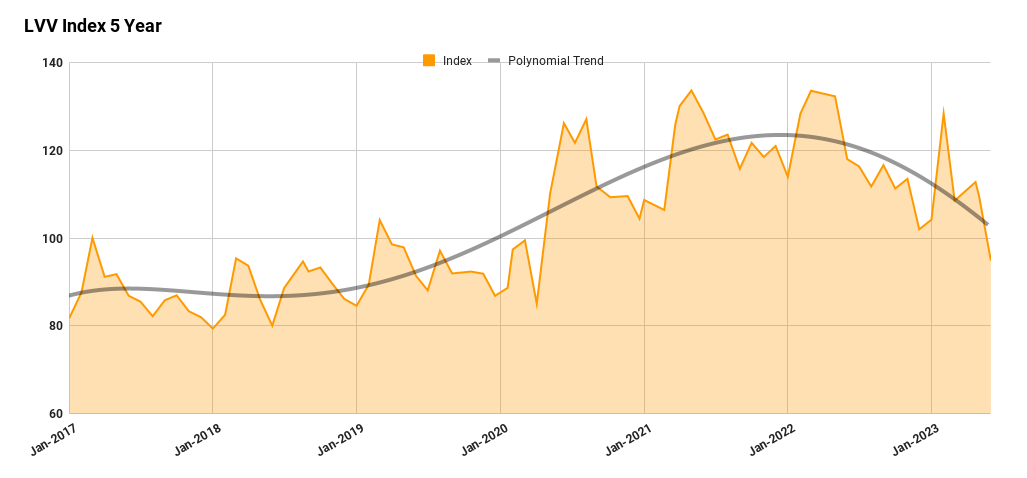

ARS Low Value Vehicle Index

ARS maintains our own observational price index for vehicles at the lower end of the spectrum. We look at high mileage, high year, and end of life vehicles presented at wholesale and monitor the market performance. The data sample that drives our index is from many points of sale throughout the vehicle remarketing industry. The recent fluctuations reflect the same trends we’re seeing in wholesale markets, with prices dropping to their lowest since 2021.

Source: Advanced Remarketing Services*

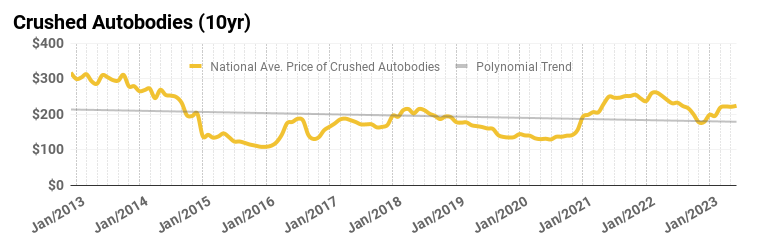

Crushed Auto Bodies

April crushed auto bodies were up 1% from March 2023 but down 12% from April 2022. May prices remained the same, with June closing out the quarter at a 1% increase from the previous month, down 3% from June 2022.

Source: Advanced Remarketing Services

Aluminum

Keeping an eye on Aluminum performance, the trendlines seem to mirror the values of other metals, with prices down 4% in Q2 and down 17% year over year.

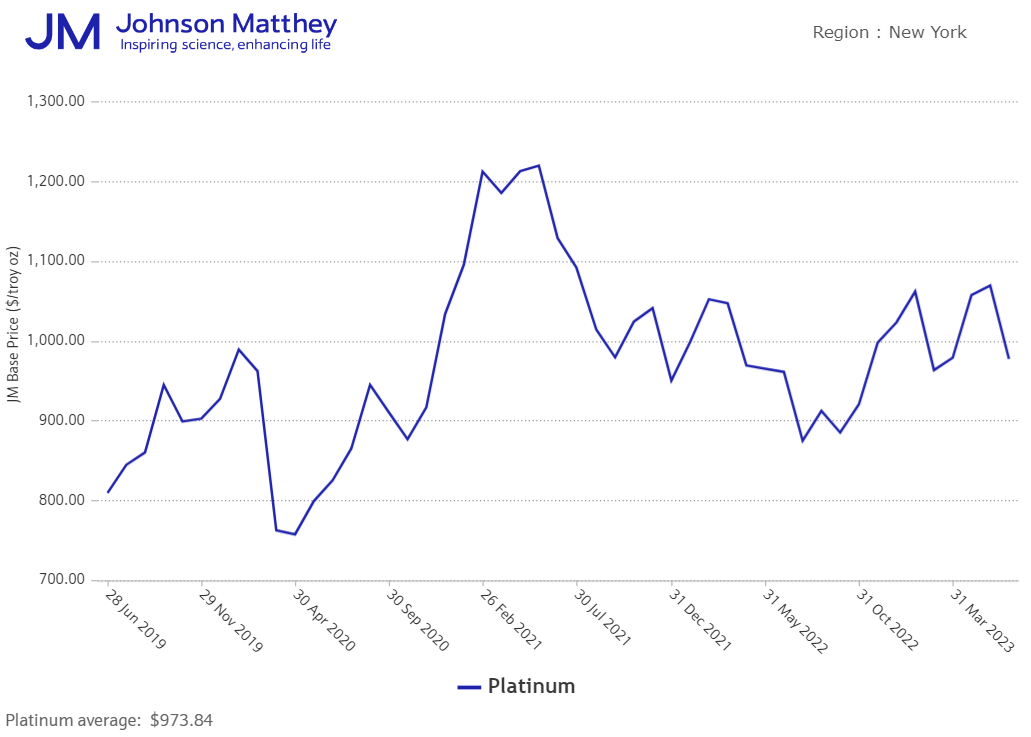

Platinum

The price for platinum is on an upward trend but has dropped to similar values seen at the start of the year.

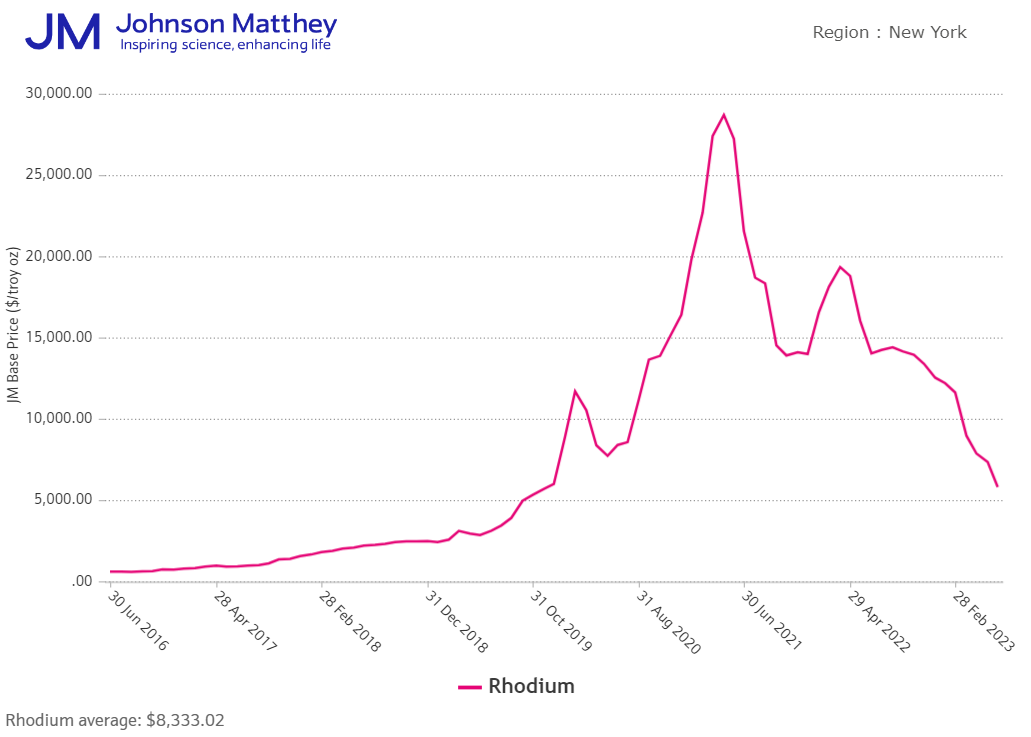

Rhodium

The value of Rhodium continues its downward trend since the start of 2022. Prices were down 21% at the end of Q2 and down 58% year over year. These prices are comparable to the early days of the pandemic.

Fuel Prices

Though technically not a metals value, fuel prices and transportation costs are impacting global demand and use of the still in demand commodities. At the end of Q2, the national average for gasoline was $3.58, down 28% from June 2022. Despite gas prices dropping during Q2, values have started to increase in Q3.