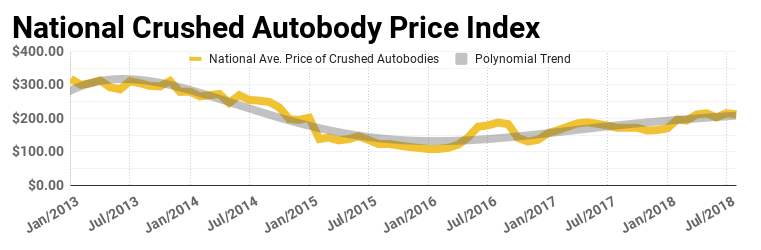

Scrap metal market takes a slight step back from 2018 high as more metal tariffs go into effect and we look to finish the year with stronger prices than recent history.

[avatar user=”zlasky” size=”thumbnail” align=”left” /]

Scrap metal prices have fallen slightly coming off a high for 2018 last month that matched the recent hot summer temperatures. While prices throughout July and into August were still very strong, there may be potential concerns for softer prices coming up due to China and their recent tariffs but we will circle back to that later. The national average price per ton for crushed autobodies fell 1.5% vs last month to a mark just above $212. Compared to 2017, the price of scrap steel is greater than 23% higher during the same month, which would be the largest year over year change so far in 2018.

At this point we are two-thirds of the way through the year and in recent history the final four months of the year have been a challenge for scrap steel. Over the last 5 years there has been an average decline upwards of 14%. However, last year it was just a 4% drop so we may be at the beginning of a new trend.

Scrap steel prices drop out west, scrap market remains flat in the east.

For more than half the country regional scrap markets suffered just marginal losses or none at all. Zone 1 (west) had a drop in scrap prices in alignment with the national average. Zone 2 (midwest) suffered the largest regional drop of over 6%. The midwest region of the United States currently has the lowest value for scrap compared to the rest of the nation.

Steel Market News: American steel imports trend down, China slaps tariffs on scrap metal, U.S. doubles tariffs on steel and aluminum imports from Turkey.

The American Iron and Steel Institute reported that steel imports were down 16% in June compared to the previous month. Overall through the same time period in 2017 total and finished steel imports are down 9% and 7% each. One of the top exporters of steel to the United States has been taking huge hits to the amount of their product being purchased all year long and it is now going to get even tougher for them. On Friday it was announced that tariffs on Turkish imports of aluminum and steel would be doubled. The tariffs that go into effect today, August 13th, will be raised to 20% on aluminum and 50% on steel. The AISI report shows that already in 2018 steel imports from Turkey are down 56% and we can only expect that number to grow now.

In other tariff news that was announced last week, China declared a 25% tax on multiple U.S. goods including automobiles, motorcycles and scrap metal. China has always been the largest purchaser of U.S. scrap but now scrap consumers are trying to find new homes for incoming cargo so they avoid these new duties. China’s scrap metal imports have already dropped by a third in the first half of 2018. While the overall idea of the tariffs is to create a more fair trade market this back and forth trade war may start to cause scrap to pile up domestically.