Scrap metal market takes largest downturn for 2018 as scrap steel prices drop nationwide.

[avatar user=”zlasky” size=”thumbnail” align=”left” /]

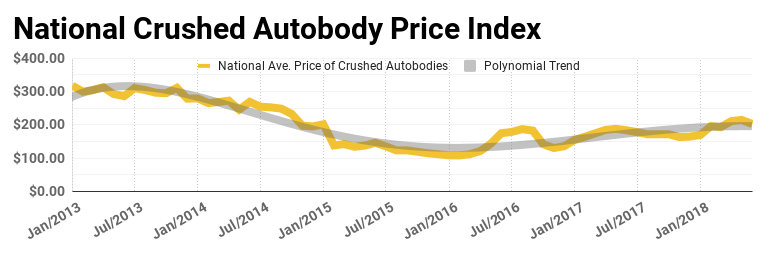

After reaching a multi year high the scrap metal market has come down slightly amidst a busy month for trade and tariff action in the United States. While our scrap metal market report in May reported the highest price per ton for crushed auto bodies since late 2014, through conversations within the industry we expected to see this reversal in growth nationwide. The national average price for crushed auto bodies dropped over 5% month-to-month but still sits over $200 – $203 to be more precise. Even though the market dropped by about $12, compared to the same time period in 2017, it is up over 10% year over year.

Scrap steel price drops vary by region; northeast hit hardest.

Taking a look back to last year the scrap metal market was in the middle of relative stability price-wise. From that time it dropped 10% through the end of the year.

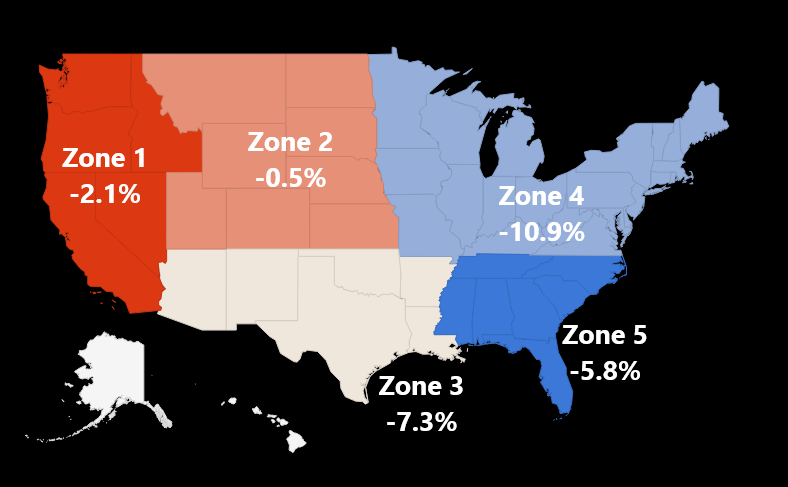

Prices dropped across the country ranging from just a slight drop (Zone 2) to a more significant drop (Zone 4). Where we saw the biggest change, in the northeast, the 9.5% scrap price increase from an month ago was completed erased. Since hitting a high and becoming one of the more valuable regions for crushed auto bodies, prices dropped almost 11%. However, the price per ton for scrap steel in the northeast still remains just above the national average.

Market News: Aftermath of steel and aluminum tariffs lifted from NAFTA partners and EU and the ensuing G7 summit outcome.

It’s now been a little more than two weeks since exemptions on steel and aluminum tariffs were lifted from NAFTA trade partners and the European Union. Soon thereafter at the G7 summit, sides were supposed to come together but instead tensions have increased between the U.S. and the other members, particularly Canada. Based on imports of steel and aluminum, the estimated loss to some of these key trading partners, and in turn potential retaliatory power, could cause more spikes in markets related to steel and scrap.

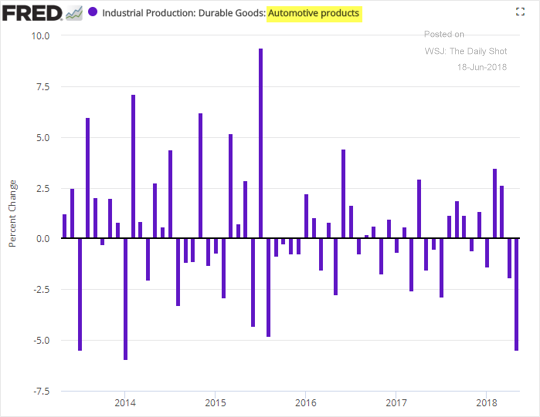

An obvious sector to look at would be the automotive market where additional tariffs could drive up the price of vehicles in the U.S. This is in addition to already rising prices from extra manufacturing costs due to the current price of steel. Currently, it appears higher cost of metals are already taking a toll on automotive production. While there is much of the year to go and many different factors at play here automakers and analysts alike can’t be too keen on this data while we are already headed for an expected down year for new car sales.