[avatar user=”jhearn” size=”thumbnail” align=”left” /]

In our last Wreckonomics™ post we looked at the used vehicle wholesale marketplace and the challenges it currently faces. In this post we’re going to dive deeper into wholesale appetites for the lowest value assets. This segment of the vehicle market is often obscured by late model or higher value items and typically isn’t tracked in most index data (e.g. NADA is comprised of up to 8 model years data only).

As we discussed, these vehicles are in greater supply than ever before, vehicles are on the road longer with an average age now at a record 11.6 years old.

This segment is growing at an absurd rate; The number of vehicles 16 years and older is expected to grow 30 percent from 62 million units in 2016 to 81 million units in 2021. WHOA. Simply stated, these are huge volumes of units that occupy the lowest rung of demand and they’re showing up in record numbers..

The presence of these assets is challenging remarketers, salvage managers, repossession executives and fleet managers more than ever. Low value units are showing up in areas of the remarketing chain where they have previously been lightly observed. Longer loan terms, subprime auto sales, title lending and damage claims on older vehicles are swelling the numbers in the wholesale marketplace. The limited demand and lowered value of these vehicles are presenting unique challenges to sellers.

Value and Demand

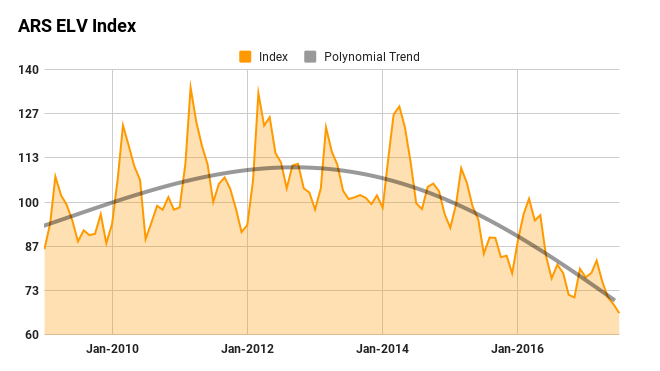

Unique to our services, ARS tracks the market on low end vehicles on a daily basis. We pull wholesale market data on high mileage, high year, low ACV units and use a mix of our own data and observed activity to produce an index that helps us work with our clients to make remarketing and channel decisions in real time. The values for these units through 2015 were at or near historic highs. However, today we’re a long way from that point and unlikely to return.

We must remember that the appetite for these assets is finite and specific. These low value assets are purchased by locally based dismantling and recycling operations. These units simply aren’t worth transporting over distances of any significance.

Negative Equity

Traditionally these units have been handled at wholesale and sold into the recycling stream via vehicle auctions. The auctions presented a useful channel to manage the transportation and distribution of these assets. However, when the costs of processing (repossession, towing, estimatics, storage, auction sale and buyer fees) begin to approach or outweigh the asset’s value, our clients regard these units as Negative Equity Units. The associated costs leave very little recovery for the seller.

To address the rising tide of negative equity units, ARS developed the mBid® application to leverage local demand for low value and end of life vehicles from ‘the field.’ Direct sale of these assets lowers processing costs, significantly reduces fee basis, improves cycle time and delivers a significant net lift for our partners.

mBid® is a comprehensive solution, managed completely by ARS. We worked closely with licensed dealers and dismantlers to design a system for distributing and managing these assets that delivers reliable information to buyers, manages logistics, processes titles and is equitable for buyers and sellers.

In our next post Wreckonomics™ 1.5: Segmentation & Tranche, we’ll look at some of the tools used by ARS to segment our partners vehicle mix and to make the very best cost benefit decisions on every unit throughout the remarketing channel.

| ARS helps our clients identify low value and ELV units in their asset pool, focus services for the remarketing or recycling and delivering the highest possible returns.

If you have a pool of low value vehicles in your portfolio or if you’re looking at ways to maximize recoveries, please reach out to us at ARS. Send us an email; success@arscars.com STAY IN THE CONVERSATION Visit ARS Market & Metals blog: https://www.arscars.com/category/market-metals/ And subscribe for updates |